LB Harrow Draft Budget 2026/27

Setting a balanced budget for Harrow – have your say

London Borough of Harrow's consultation on the Draft Budget for 2026/27 runs for six weeks from 19 December 2025 until 23:59 on 29 January 2026.

What is this consultation about?

Like almost every council, Harrow faces serious financial pressures. Around two-thirds of our spending goes on vital care and support services – from helping vulnerable children and adults to supporting families and individuals at risk of becoming homeless. We spend £135 million out of £215 million on supporting vulnerable adults and children with complex needs and disabilities. Our bill for temporary accommodation remains consistently high, at around £19 million a year. These are statutory services, which the council is legally required to provide, and where spending cannot easily be reduced.

Across London, councils face a £1 billion funding gap this year, expected to rise to more than £4 billion over the next four years. Already, 30 councils in England – including seven in London – have asked the Government for emergency financial help. London Councils warns that, by 2028, half of all London boroughs could be asking for Exceptional Financial Support (EFS) to balance their budgets and avoid bankruptcy.

Thanks to careful financial management, Harrow is not in that position. But by law we must deliver a balanced budget, and that means making tough choices. We aim to protect the services residents rely on, get the best value for money, and make services more efficient.

This consultation asks for your views on our draft budget for 2026/27, including fees and charges for services such as parking, planning support, commercial waste, and more.

Where does the money come from?

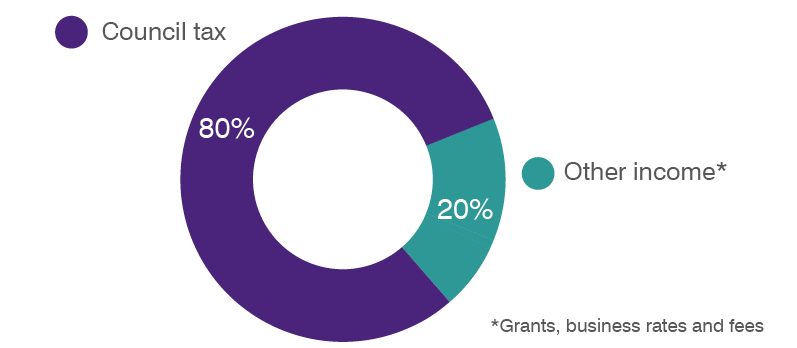

Most of our budget comes directly from residents through Council Tax. Around 80 per cent of everyday spending - £173m out of £215m – is paid this way. This is one of the highest proportions in London and makes Harrow one of the most Council Tax dependent boroughs in the capital.

Most London Boroughs rely on Council Tax for between 25 and 65 per cent of their spending. In contrast, Harrow is one of just three London Boroughs where more than four-fifths of the entire budget comes from Council Tax. This is because Harrow receives relatively little from business rates and Government Grants compared with other London areas.

Around 20 per cent of the Council Tax we collect goes straight to the Greater London Authority (GLA) to fund services such as policing, fire and rescue, Transport for London, free school meals and programmes to improve air quality and tackle climate change.

We also receive Government funding, but this can only be used for specific services like schools, public health, and housing benefits.

The Government’s Fair Funding Review will change how money is shared with councils. We received the details on 17 December and are still working through what this means for us. Early analysis shows that Harrow will receive around £7.4 million in additional grant funding for 2026/27. This is great news for Harrow, but still leaves us with a budget gap of just under £10 million next year.

The Fair Funding Review also makes it very clear that Government expects councils to increase Council Tax in 2026/27 by 4.99% (2.99% for general services and another 2% for adult social care).

Another key source of income is Business Rates. These are taxes paid by businesses for their premises. The council does not set these rates – the Valuation Office Agency determines the rateable value of each property, and the Government applies a calculation that decides the final charge before any reductions or reliefs are applied.

The Council currently keeps around 30% of the total Business Rates collected each year – estimated at £15.5 million in 2025/26. The remainder is shared between the Government (33%) and the GLA (37%). Government changes to business rates will take effect in 2026/27.

By the end of the year, we will know exactly how much funding we will receive through a new three-year finance settlement, and the updated Business Rates income for 2026/27. With high costs in areas like housing and social care, we may have to do more with less, making difficult choices while continuing to support our most vulnerable residents.

We also hold reserves – money set aside to protect the council’s finances if something unexpected happens, or to help if the everyday running costs of the council suddenly change. But, like savings, once reserves are used, they are gone.

Our income sources

How the council spends its money

When we talk about the council’s budget, you will often hear the terms revenue and capital. Simply put, revenue is about every day running costs, while capital is about long-term investment.

Think of it like your household. Revenue covers things such as energy bills, petrol, or your TV licence, while capital is the bigger spend - like buying a house or building an extension. For the council, revenue expenditure includes salaries, building maintenance and running costs for services like refuse (bin) collections and libraries – this is funded through Council Tax and fees.

Capital spending, on the other hand, is used for improving council assets, such as road improvements and our council homes programme, where we have repaired properties, built affordable homes, and purchased existing homes to increase supply. Capital money cannot be used for everyday costs. It comes from Government grants and from low-cost borrowing.

That means any savings we need to make must come from our revenue budget.

Where your money goes: major spending pressures affecting the budget

![]()

What happened in 2025/26?

By the end of this financial year, we expect to have spent £223 million delivering services to 263,000 people. Our key priorities are:

- A council that puts residents first

- A borough that is clean and safe

- A place where those in need are supported.

In April 2025, Council Tax rose by 4.99% to help meet rising costs and demand for the services. At the same time, we reduced our running costs through efficiency savings, while minimising disruption to the services residents rely on most.

Our investment in things you told us were important to you

We continued to invest in the things you told us matter most for safety, quality of life, and the local economy – such as cleaning streets, tackling fly-tipping, fixing roads and continuing with one-hour free parking.

![]()

What are we proposing for 2026/27

Our draft budget for next year (2026/27) is designed to protect essential services and focus on the things that matter most to our residents. We will do this by working smarter, driving efficiencies, and negotiating better contracts to make every pound count.

Rising costs and growing demand for services mean we face an estimated £9.7 million shortfall next year. To help close this gap, like many councils, we are proposing a 4.99% Council Tax increase (2.99% for council services and 2% for adult social care).

Unlike some councils, we will not seek Government approval to raise Council Tax beyond this level. Fees and charges will also rise by 4.5%, in line with inflation but not beyond, to keep services fair and sustainable. We know these changes affect household budgets, so we are working hard to keep increases as manageable as possible while maintaining essential services.

Despite these measures, rising demand and costs - especially for vulnerable residents - mean we face ongoing financial challenges. We will need to use some one-off reserves in 2026/27 to balance the budget, while continuing to drive efficiencies and secure the best value for money.

We recognise that as well as driving efficiencies, we need to continue to deliver services that put residents first, keep Harrow clean and safe, and support those most in need. Next year, key investments include:

- Improving our roads: Continue our three-year, £42 million investment to repair potholes and resurface roads, improving safety and the quality of journeys across the borough.

- Enhancing street cleansing: Deliver cleaner, better-maintained streets through year two of our £1 million investment.

- Upgrading parks and open spaces: Deliver the second year of our £6 million, three-year programme to improve facilities, enhance green spaces, and increase the number of Green Flag parks.

- Freezing garden waste charges: Keeping charges at 2024 prices, while other boroughs increase their charges.

- Keeping you and our public spaces safe: Invest £300k to upgrade and expand CCTV in town centres and parks.

- Clean, safe and well-maintained car parks: Over the next three years invest £900k in council-owned car parks.

- Continuing one-hour free parking in all council-owned car parks and on street bays.

- Supporting vulnerable adults: Provide an extra £8.4m to help residents with complex needs.

- Delivering more affordable homes: Invest £21m to purchase properties and tackle homelessness.

- Creating better community spaces: Transform disused park buildings into high-quality spaces for local use with £600k investment.

We can deliver these improvements thanks to strong financial management, careful savings and a focus on value for money.

How can you help?

This consultation is your chance to have a say. We want your views on how we spend money, set fees, and protect services. Please take a look at the information provided and complete the survey at the bottom of this page.

Before you complete the survey…

We recommend you

Watch our video that explains more about the budget pressures we face.

Read the budget report which provides more information about how we plan to spend money and where we need to make savings.

Anything else?

We've also included some Frequently Asked Questions and answers to help you navigate council finances and budget-setting.

To request a hard copy of the consultation, please call 020 8863 5611.